Digital collectibles or non-fungible tokens (NFTs) are currently experiencing a resurgence despite the ongoing bullish momentum in the broader crypto market.

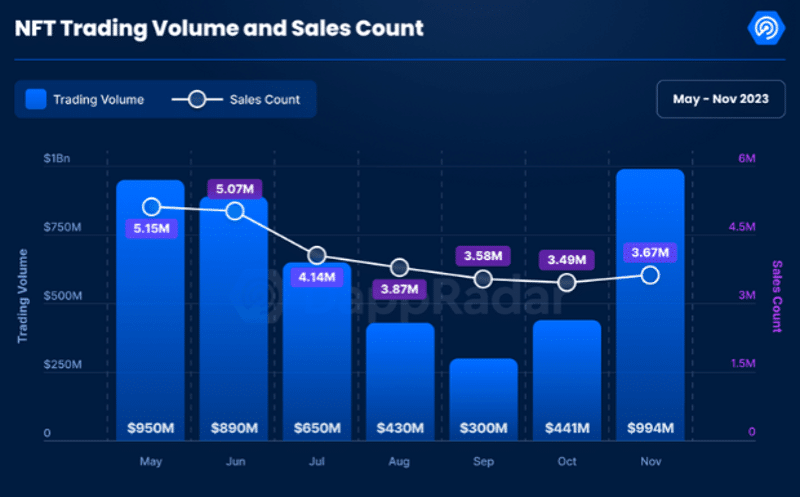

Capturing this shift, DappRadar’s November industry report revealed that the NFT ecosystem has sustained a positive trend for the second consecutive month.

According to the decentralized application (dApp) monitoring platform, the digital collectible ecosystem witnessed an impressive 125% surge in trading volume in November.

However, this is not the only impressive data captured from the digital collectible ecosystem.

DappRadar also reported a modest 5% increase in sales, contributing to a total transaction output of 3.6 million in November.

This indicates that NFT investors are increasingly active in buying and selling their favorite pixelated blockchain-based assets at premium values.

The average transaction value has notably risen from $126 in October to $270 in November, representing a 114% increase within a 30-day period.

Additionally, Unique Asset Wallets (UAWs) have seen substantial growth, particularly in on-chain gaming, which reached 3.4 million UAWs, reflecting a 14% increase while holding a 34% industry dominance.

Furthermore, DappRadar highlights the significant turnaround in the fortunes of the decentralized economy in the last three months.

Following a broader interest in offering exchange-traded fund (ETF) services for the two most popular cryptocurrencies (Bitcoin and Ethereum) by several legacy-backed asset management firms, the crypto market has experienced a resurgence.

Bitcoin, the chief catalyst in the market’s uptrend, has broken through its $30,000 shackles and now sits comfortably above the $40,000 price peg in less than a month while recording over 150% increase year-to-date (YTD).

This remarkable rally has seen the crypto market climb to $1.6 trillion in its market cap within the stated period. Nonetheless, the NFT sector has also demonstrated notable progress in recent months.